- About Us

- Areas We Service

- Our Services

- Blog

0477 76 2937

- About Us

- Areas We Service

- Our Services

- Blog

A few factors influence whether your insurer will cover a leaky or broken pipe. And whilst there isn’t exactly a straightforward ‘yes’ or ‘no’ answer, this guide will help you understand under which conditions are leaking pipes covered by homeowners’ insurance and what you can do to make sure you are covered in case of an emergency.

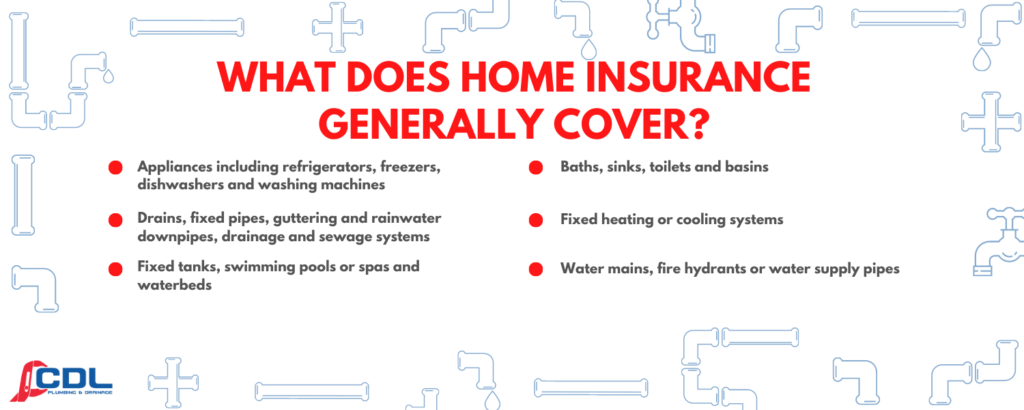

Homeowners insurance policies cover unexpected or accidental damage due to a broken or ruptured pipe, overflow from stormwater, and damage from floods and storms. Your standard insurance policy will also likely cover the cost of locating the leak and repairing the damage caused but not cover gradual damage that occurs over time that may have been avoided by frequent maintenance or due to the occupant’s negligence. It is crucial that you have any repairs or upkeep work required as soon as possible to prevent long-term damage to your home and leave you out of cover.

Your insurance policy may cover the costs associated with locating and fixing the damage caused by your leak. The policy, in many instances, will not cover the cost of repairing the leaking pipe itself. If there is damage caused by neglected pipes or taps, worn-out seals, or waterproofing membranes, you might also not be covered. This answer is not absolute, and clarification should also be sought from your policy provider.

Make sure to take extra special care when reading the Product Disclosure Statement of your insurance policy. This section will aid you in swapping your insurance provider, making any necessary adjustments, negotiating additional coverage, and also providing an answer to the question of “Does insurance cover water leaks?”. It is also imperative that you routinely check your house for structural damage and leaks and get these issues fixed quickly to avoid a headache later on. This is especially important after a storm or other extreme weather to assess any damage.

Water damage can take place in a multitude of different ways. It can come from a burst pipe, backup from a sewer or blocked drain, or after a storm or flood, and coming from even the most minor leak from a pipe in a way that is almost undetectable until it is too late. Most damage can generally fit into either the category of ‘sudden and accidental’ or ‘gradual’. Broken pipes and damage from natural disasters are usually classed as sudden or accidental and will be covered by your insurer. However, your insurer does not cover any gradual damage caused by leaks and poor maintenance.

Further to your insurer's understanding of gradual water damage above, examples of gradual water damage include the following:

The above examples are rarely covered by insurance companies, as they involve some of the most common household emergencies. Many claims made for these sorts of damages might not be successful. Many standard homeowners’ insurance policies include a clause that excludes these gradual water damage nightmares! So, asking your insurer, “Are leaking pipes covered by homeowners insurance?” will often warrant a response telling you to check your Product Disclosure Statement within your insurance policy and come under the banner of gradual water damage.

In all rooms of the house, water damage can look like the pooling of water around appliances or cracked and warped features near the floor. If you notice any signs of discolouration on your benchtops or furnishings, you may also have water damage in a nearby area. If your home or office has a musty or mouldy smell, or if there is a feeling of dampness on the carpets or floorboards.

Finally, keep a close eye out for mould growing around these damp areas. Flexi-hoses are commonly installed in many homes and, without regular maintenance, can cause severe damage to the surrounding areas. Check for wear and tear such as discolouration, exposed rubber lining or the braid being separated or splintered.

As mentioned, a broken water pipe will only be covered by insurance in the case of an emergency, not as the result of neglect. You might be questioning, does home insurance cover water main break? Well, if your break comes as the result of a sudden or accidental incident, then yes, it will be covered. However, if you have allowed your water main to deteriorate due to a lack of plumbing maintenance, you may be out of luck. It is essential not to take this risk and call CDL to use our expert team in backflow prevention to keep your water main operating smoothly.

Beyond just wondering, are leaking pipes covered by homeowners insurance? It would help if you also were taking steps to avoid water damage altogether. There are many preventative steps you can take that ensure your home is safe and covered in the event of severe water damage.

Routinely search the areas listed above for any signs of water damage and take the time to inspect those hard-to-reach places, especially at the base of any water fittings like toilets or showers.

It is surprising how often a severe leak can happen when you are away. Throughout extended breaks in use, pressure may build up, which can cause the pipes to burst.

Regular maintenance by CDL's professional plumbing team will ensure that your home is safe from water damage from leakages. We can’t claim to be above natural disasters. Still, we can confirm your plumbing is fully equipped to deal with these situations as best it can and make sure you are doing everything you can to ensure you are covered for any issues caused by broken water pipes.

Give CDL Plumbing a call today on 0477 76 2937 to book your next plumbing service in Newcastle or Lake Macquarie.

CDL Plumbing & Drainage are expert plumbers and gas fitters servicing Newcastle & Lake Macquarie from our Gateshead HQ. We have over 15 years of experience and specialise in all domestic and commercial plumbing, able to take on large-scale drainage projects. Fully qualified (Level 4), licensed & insured with free quotes. We have 2 teams of friendly and reliable plumbers with fully equipped vans.